If We're Going To Tax The Rich, Then Let's Tax The Rich

Due to the political courageousness of President Obama (there is simply no other way to put it), the folks inside the Beltway are finally having a serious discussion about taxing the rich. Obama is not only strongly fighting for higher tax rates on the higher-income earners, but he was the one who put the subject front and center in the election season -- when he could easily have punted it to a non-election year.

But the "tax the rich" policies so far being discussed (at least the ones that leak out to the public) are laughably timid and tame, when you really examine the big picture. So far, what is making Republicans howl is President Obama's plan to end the Bush tax cuts on the top two marginal income tax rates, which would raise them from 33 percent to 36 percent, and from 35 to 39.6 percent. Seen one way, that's impressive, since tax rates haven't gone up in such a fashion since President Clinton's first year in office. But seen another, it's not all that radical at all.

Consider the fact that nothing Obama is doing is going to "fix" the problem of Warren Buffett paying a lower tax rate than his secretary -- a problem Obama has repeatedly said he'd like to tackle. On "entitlements reform," only a few lonely voices crying in the wilderness are suggesting ending the most regressive federal tax around, by scrapping the cap on income for Social Security payroll taxes. Also seemingly forgotten in this debate is the proposal for a "millionaires' tax" or a "transactions tax." The real measure of whether Democrats and Republicans are both selling smoke and mirrors is whether they permanently fix the Alternative Minimum Tax -- again, a subject which has barely been mentioned.

If we're really going to get serious about taxing the rich, why not... well... tax the rich? Chances for changing the tax code for upper-income folks don't come around all that often (it's been twenty years since the last one, remember), so why not push not only for higher rates, but to fix some of the most glaring ways our tax code favors those with monstrous incomes. Let's take a look at a few of these ideas, one by one.

Scrap The Cap

This one is pathetically easy to understand, and pathetically easy to fix. Many Americans aren't even aware of how the lower 90 percent of paycheck-earning Americans pay higher taxes than the upper ranks.

Social Security taxes are supposed to be a "flat tax" -- everyone pays the same rate. It's so simple that Social Security taxes ("FICA," on your paystub) don't even appear on a normal person's income tax form. It's a straight 6.2 percent of your income that gets taken out, every single paycheck. Except for the wealthiest, of course -- they pay less.

Because only (currently) the first $110,100 you make in income is taxed. Every dollar you earn up to this limit is taxed at a flat 6.2 percent rate. Every dollar you make over this limit is taxed at a zero percent rate. Meaning most Americans don't make it over the cap, and thus pay a full 6.2 percent on their entire income.

[Technical notes: Right now we are in the midst of a temporary "payroll tax holiday" and only 4.2 percent is being taken out of your paycheck -- but this is going to end at some point, and the tax will go back up to the baseline of 6.2 percent. Also, your employer matches this percentage, but self-employed people pay the full 12.4 percent. Neither of these facts are reflected in the charts below, which have been simplified for clarity.]

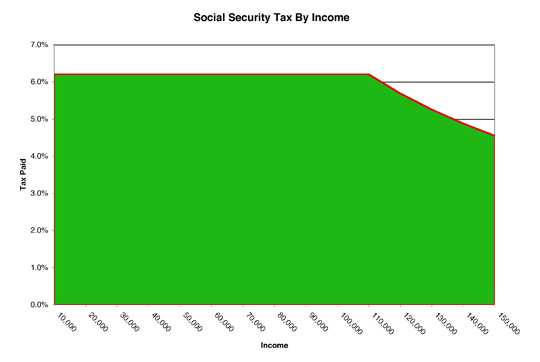

Here is a chart showing what percentage in Social Security taxes people with modest incomes actually pay, from $10,000 to $150,000 income:

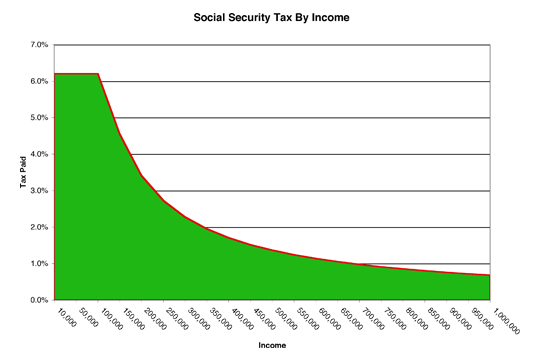

Everyone pays the same 6.2 percent up until that $110,100 limit. From this point on, the percentage drops because once the cap is hit, you're done paying the tax for the year. Someone making $150,000 a year pays only 4.6 percent, as a result. Now let's look at a higher income range -- one which begins to show the massive tax break higher income folks get:

This shows income up to a million dollars a year. The tax rate steeply falls until about $250,000 a year (who pay 2.7 percent), and then falls off more slowly as incomes rise. When you hit $750,000, you are paying less than one percent a year in Social Security taxes. By the time it hits a million bucks a year, it's down to 0.7 percent. Which brings us to the real top earners:

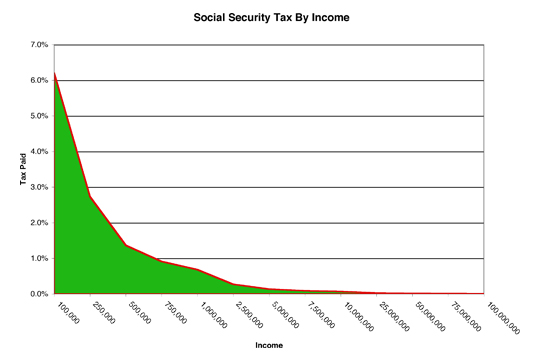

At five million dollars a year in income, the tax falls to one-tenth of one percent. A firefighter pays 6.2 percent, but if you clear five million you pay 0.1 percent. At 75 million a year in income, the figure falls below one one-hundredth of one percent -- only 0.009 percent.

Want to "save" Social Security? Scrap the cap. Make everyone pay the same flat percentage rate. Flat taxes are bad enough, but regressive taxes -- defined as "those who have more pay less" -- should be an outrage. Scrap the cap. Social Security could be saved for decades by this one simple step. Make every one of those charts a flat line.

Solve The Buffett Problem

Warren Buffett, as everyone should know by now, pays a lower income tax rate than his secretary, despite the fact that Buffett makes one whale of a lot more income than his secretary does. This, despite the supposed-progressive nature of the income tax system. The reason is the biggest loophole of them all. This mother of all loopholes? Treating income rich people make differently than income normal people make. You see, the way Mitt Romney makes most of his money is taxed at a much lower rate than the way a nurse or teacher makes money. Which is why Romney is able to pay less than 14 percent income tax on an income of $20 million. Astonishingly, if the Paul Ryan budget had been made law, Romney would have paid less than one percent on the same $20 million income. I speak, of course, of "capital gains" (and "dividends" as well, but I'm just going to lump them all together for the sake of conversation).

Of all the thousands of ways an individual can make money (or "create an income"), only one is taxed at less than half the rate of the others. It happens to be "making money on Wall Street and the stock market." What a surprise! The method the already-wealthy use to increase their wealth is treated separately by the tax code. It is taxed less than half of what you earn in a paycheck. This is the "Buffett problem."

The solution to this problem is easy, too. Tax all income the same. Equality of taxation! It doesn't matter how you make that dollar, the government should tax it exactly the same -- anything else is simply not fair. In fact, this should be made progressive, too -- which will instantly neutralize all the howling from the anti-taxers about how this will hurt the middle class.

Make all income made through capital gains up to $250,000 each and every year tax-free. No capital gains taxes whatsoever on any money made up to the $250K limit -- you can just write off all profits up to that point on your yearly tax form. Then every dollar made above that limit is treated as income. Period. And taxed at the same rate as every other type of income.

This removes the argument that there are small investors who would be harmed. Very few Americans' retirement plans make $250K in income each and every year. In fact, it would be a massive tax break for small investors, which would have a positive impact.

But for the Buffetts and the Romneys of the world, they'd be paying the same (or greater) tax rate as their secretaries. And they, too, get to write off a whopping quarter-million of it each and every year, as an incentive. Problem solved.

Tax Wall Street Speculators

Institute a transactions tax of 0.25 percent on all Wall Street transactions over a certain limit per year. Make all the stock trades you want up to, perhaps, $250K per year tax-free. But then on trades over this amount, charge a fraction of one percent as a "speculation tax." This idea isn't original (actually, none of these ideas is original), I should mention. Raise money for the Treasury by putting a very gentle brake on the stock market, to the tune of twenty-five cents on every $100 traded. Wall Street bears a large portion of responsibility for our fiscal problems, so it's time to make them contribute towards fixing them.

Cap deductions

Right now this is the favorite solution of the Republicans (of course, they want this solution and none of the others, to be clear). Cap what rich people can deduct on their income taxes. The figure I've heard tossed around, however, is way too low. Capping deductions at $50,000 would snare a lot of folks making under $250,000 per year, I would be willing to bet. So raise the limit enormously, but make it a hard cap.

Let upper-income folks have a full quarter-million in deductions each year. They can write off up to $250,000, no matter how they're deducting it and no matter how much their total income (this would be separate from the $250K capital gains break described above, I should mention). But that's it. This change could be accomplished by changing a few words on the last box on Schedule A to read "if this amount is over $250,000, then just enter $250,000." That's all it would take. No more writing millions of dollars off each year, sorry. Again, by setting the limit extremely high, this would not ensnare anyone in the middle class at all.

Add Two Tax Brackets

This one's pretty easy, too. One of the things Republicans (stretching back to Ronald Reagan) have been successful at over the years is not just lowering tax rates, but reducing the number of tax brackets that exist. Most of this reduction has happened at the upper end of the scale (which should come as no surprise).

This one is easy to fix, and key Democrats such as Senator Charles Schumer have been pushing the idea for a while now. Create a millionaires' tax bracket. In fact, I'd go further and create a bracket at one million dollars in income, and another one at ten million dollars in income. This removes the squabbling about the "middle class" versus "the truly wealthy" as anyone pulling down a cool million a year simply cannot be classified as "middle class" by anyone (at least not with a straight face). We had multiple tax brackets for a reason in the past -- to tax the stratosphere of the income levels. Let's get back to this way of targeting the upper ranks once again.

The AMT Big Lie

I've offered up all of these ideas today to show how timid the proposals currently being discussed truly are. I would bet that none of the problems above will even be addressed in the fiscal cliff negotiations, and I don't expect them to be addressed at any time in the next year, either.

There's a quick and easy way to show how the politicians in Washington -- from both sides of the aisle, mind you -- are simply playing games when they talk about any "long-term solutions" to the tax code. They are, indeed, not going to institute a fix on any sort of permanent basis, mostly because then they'd have to tell a certain uncomfortable truth about the budget projections. Which they're just not going to do -- from either side of the political divide.

Here's the test: will the Alternative Minimum Tax be fixed for more than one year in any "deal" which emerges? The answer to that will be: "No. No, there will not be a permanent fix to the AMT."

Which is how you will know that both sides are simply lying about what the budget will look like in the next ten years. Flat-out lying. Both sides.

The Alternative Minimum Tax was created to solve exactly the same problem they're trying to solve now -- making the wealthy pay their fair share. It was created to rein in abuse of deductions and loopholes. It was created to make sure the wealthiest paid at least a minimum of taxes (it's right there, in the label). It is, in short, the perfect solution to the problems they're now trying to hash out.

Instead of upping rates, instead of fixing loopholes or deductions, the politicians could instead just fix the AMT and return it to its original purpose of snaring ultra-wealthy folks who are trying to lower their tax liability on each year's tax form.

The problem with the AMT is that the limit was set so long ago that it is laughably low today (Nixon signed the original AMT into law). But the politicians in Washington play a game with it, each and every year, like clockwork. The game is called "let's pretend it's going to exist for nine years out of ten, because it makes the budget projections look so much better." When figuring a ten-year budget, the next year will show an "AMT fix" where the AMT limit is raised to where it should be, to only apply to the very wealthy. But the nine years after that will show the AMT levels at the old rate, because such smoke and mirrors means nine years of "tax revenue" which is simply never going to appear gets added into the mix. With nine years of such falsehood, to put this another way, it makes it much easier to project smaller budget deficits.

Each year, Congress "fixes" the AMT, right before the end of December. Each year, they only fix it for a single year. Nobody wants to be the one who points out the lack of clothing on the Emperor, because then the other side will accuse them of wanting to "explode the deficit."

So while there is indeed a vehicle for taxing the rich in a way which lays down clear rules and clear targets -- a way which has existed since 1970 -- it will not be used in the fiscal cliff deal. A permanent fix will not even be discussed, I would wager.

If President Obama really wanted to clearly and permanently change the tax structure for the wealthiest Americans, he would be out there pushing for all of his ideas to be wrapped into the one package of a permanent AMT fix. Instead, this will be treated as an afterthought in the whole debate -- it'll barely rate a footnote in the stories which appear about any impending deal. Perhaps in the fifteenth paragraph of an in-depth newspaper story will be the line "...and they've also agreed to the standard one-year fix for the AMT."

If you want to tax the rich -- if you really want to address the problems in our tax code that outrageously favor the wealthiest among us -- there are multiple ways to do so. I understand why Obama has drawn a political line in the sand over raising rates on the top two percent of earners. But it has focused the debate only on this one part of an overall solution. There are plenty of other ways to make the tax code more fair, more balanced, and more evenhanded for the middle class.

My guess is none of them will happen soon. Perhaps Obama will claim victory and get rates raised to 39.6 percent, or perhaps John Boehner will talk him down to 37 percent. But because the media and all the politicians have focused on this one battle royale, my guess is that virtually no attention will be paid to any of the other fine ideas out there to tax the rich. Which is a shame. Because these opportunities seem to come along only once in a generation.

-- Chris Weigant

Cross-posted at Business Insider

Cross-posted at The Huffington Post

Follow Chris on Twitter: @ChrisWeigant

Chris,

SS was never supposed to be a general source of revenue. It was intended solely to ensure people save something for retirement. Since SS benefits are capped its entirely appropriate for the taxes to be capped as well. Your argument is only true if SS is simply a general revenue tax, a claim conservatives have been touting by way of avoiding responsibility for repaying all those SS dollars they've looted over the years to pay for tax cuts. I'm all for raising taxes on the rich to a more reasonable level, but not by stealing from them the same way they've stolen from us. SS is about funding individual retirement not raising general revenue. It should be regressive. The more money one has the less need there is for SS.

BTW, my personal preference is simply to treat capital gains and transactions as simple income and tax them accordingly. There is almost no way for a wage earner to legally receive income that isn't subject to taxation. Why should the rich have such opportunities? If I earn money its subject to taxation, immediately. The same should be true for the wealthy. Also a transactional tax would have the added benefit of curbing program trading abuses, and coupled with capital gains as ordinary income would generate a huge increase in the revenue stream.

[PROGRAM NOTE:]

My ISP almost went down from the amount of traffic this article generated when it appeared over at Huffington Post. This caused momentary interruption of service here at CW.com, but everything should be up and working now. Interruptions may be possible for the next 18 hours or so, I will keep everyone posted. We'll keep an eye on it, just wanted to offer an explanation for anyone who had site problems in the past half-hour or so.

-CW

There is another Buffett problem..

That being letting the Rich get away with NOT paying any taxes at all, to the tune of (in Buffett's case) over a billion dollars...

Which is why I simply CANNOT support the efforts of the Democrats..

Oh, they talk the talk just fine.. But when it comes to actually sticking it to the rich???

Well, it's obvious that the Dems are only interested in sticking it to the rich that vote GOP...

It all goes back to what I said in a previous commentary and what I have said over and over and over ad nasuem...

CLEAN YOUR OWN HOUSE FIRST!!

Ya'all claim that the Dem way is better, that the Dem way works??

Prove it!!

Get your Dem leaders to walk the walk, rather than just talk the talk..

Then, and ONLY then, will you have the moral highground from which to ethically preach to others..

Michale

0317

CW-

I tried to post last night to see if you'd heard the good news (about the explosion of interest in this article) and the site was down.

Here's part of what happened. When I pulled up Google News last night, I thought I recognized the title of an article on the front page and then realized where I recognized it from.

Here's the picture from the Google News front page last night ...

http://www.thereckoner.com/wp-content/uploads/cw_tax_the_rich.tiff

Well done ... excellent article!!!!

-David

I have always said that I don't have a problem with taxing the rich..

And I don't..

*MY* beef has always been that Democrats are saying that "the rich" include a portion of the middle class..

David and I even came to some sort of agreement about this a while ago..

Rich = Any person/business/family that makes over $1,000,000 a year...

I simply CANNOT support ANY tax action against those who make LESS than 1 mil a year..

If Democrats were to go solely after the rich, rather than the upper levels of the middle class, they would find a LOT more sympathy for their cause.

Of course, they would also find a lot more sympathy for their cause if they actually went after ALL of the rich, instead of just those who vote against Democrats..

But that's another rant.. :D

Rich = Entities Making More Than 1 Mil

If the Dems did that, I could almost be on board with them...

But the Dems won't do that..

As CW said, they would just rather go hand in hand with the GOP and say what fine livery the emperor is wearing.

Michale

0318

I simply CANNOT support ANY tax action against those who make LESS than 1 mil a year..

Which is NOT to say that I now think that taxes is the way to go..

I still maintain that taxes won't do diddley squat unless it is coupled with some real spending discipline.

And here again is where the Dems are found wanting..

Why won't Democrats put some real and defined spending cuts on the table??

The Left is demanding specific taxes from the Right...

Yet, the Left is not willing to get specific about what spending cuts will be made..

Ya'all go on and on about "fair" yet ya'alls idea of "fair" is that the GOP make all the compromises and the Democrats make none..

How is that "fair"??

Answer: It isn't...

Until such time as specific spending cuts are put on the table, the GOP is fully within their purview to tell the Dems to go pound salt...

The Dems don't mind. It's been their intention to push the country over the cliff all along..

Dems are hoping that the GOP gets the blame..

I think the Dems are in for a very rude shock...

2014 is shaping up to be a good year for the GOP..

But what do I know.. I thought 2012 was going to be a good year.. :D

Michale

0319

I have always said that I don't have a problem with taxing the rich.

Actually, it's simply repealing all the huge tax breaks the rich have won for themselves.

Capital gains ...

The social security tax cap ...

The Bush tax cuts

CW makes some great points in this article about how much the tax system has been skewed over the years to benefit the wealthy.

Why not reform it so that it's fairer and not skewed towards the wealthy?

Let's start with a simple question: Are you for or against this?

-David

Why not reform it so that it's fairer and not skewed towards the wealthy?

Let's start with a simple question: Are you for or against this?

I am COMPLETELY and 1000% for it...

But the difference is, I am for it as it applies to Buffet AND Adelson....

Democrats are only for it as it applies to Adelson...

Which is why I can't support the Democrats in their endeavors.. Because they refuse to clean their own house first, they show me that they are not sincere and are only looking to further their own agenda at the expense of the middle class...

But in answer to your question, I am unequivocally FOR it...

I simply prefer leaders with more integrity to lead on the issue..

Yea, I know.. A pipe dream...

Michale....

0320

I am COMPLETELY and 1000% for it.

Glad to hear it!

But the difference is, I am for it as it applies to Buffet AND Adelson.

The reforms proposed don't target any specific billionaires. Not Adelson. Or Buffett.

They eliminate previous breaks given to all the wealthy.

Is there a reform you're seeing that somehow favors one group of wealthy over another?

-David

Is there a reform you're seeing that somehow favors one group of wealthy over another?

Why is Buffett allowed to get away with oweing over a billion in back taxes and Adelson have the IRS crawling up his arse???

The reforms proposed don't target any specific billionaires. Not Adelson. Or Buffett.

Yea, in theory..

But, as we have seen, in actual practice Democrats favor those who vote Democrat...

This has happened much MUCH too often for it to be mere happenstance...

So, while I completely agree with you in principle, we have seen how the Democrats put it in play...

So, unless you can guarantee me that Democrats will apply these new taxes fairly, I will oppose their agenda as much as humanly possible..

Michale

0321

Why is Buffett allowed to get away with oweing over a billion in back taxes and Adelson have the IRS crawling up his arse?

Could you be a little more specific? All I could find were some rants from right wing blogs without any insight into this accusation.

I did, however, trace the history of this accusation. It seems to date from a New York Post article.

http://www.nypost.com/p/news/opinion/editorials/warren_buffett_hypocrite_E3BsmJmeQVE38q2Woq9yjJ#ixzz1WRoIlYSf

Note the unbiased approach: "Warren Buffett, hypocrite"

Here's how the story is "cooked".

The Post cites tax issues from an annual report. It never specifies what these issues are.

Then it claims that Buffett should be paying 35% instead of the 15% on capital gains.

Ummm ... the law is 15% on capital gains. Which is why Buffett's tax rate is so low. Which is what he is arguing: it's too low.

But they try to make him look crooked like you're trying to make him look crooked. Because you have no argument so you attack the man.

I believe the truth is he would have owed $1 billion if he had to pay at a 35% rate instead of the current US rate of 15% on capital gains.

He hasn't broken any law or dodged any taxes. He simply would have owed $1 billion if the rate were higher. So would a lot of people if capital gains were taxed higher.

Compare this to Sheldon Adelson who is being investigated for actually avoiding current tax law.

Bullshit ... debunked

-David

Bullshit ... debunked

BTW, this comment is targeted at the NY Post. Not you, Michale. Sorry if taken otherwise. It just makes me angry when people who should know better publish stuff.

Ya know what really chaps my ass about Democrats??

The blatant double standard...

Democrats threaten violence on Michigan House floor

http://washingtonexaminer.com/article/2515629#.UMdotKweUs-

If a Republican had stood up and declared there will be violence if they don't get their way, the Left (including everyone here) would have gone utterly batshit.

You want another example??

Imagine if Bruce Willis had said on SNL, "I am in a great movie!!! I get to kill all the black people. How awesome is that!??!"

Once again, the Left (and everyone here) would have gone ballistic...

Yet, that's EXACTLY what Jamie Foxx said about white people and no one said dick...

It's pure, unadulterated and totally blatant hypocrisy...

And from the Left???

{{{{chiiirrrrppppp}}}} {chiirrrrppp}

Michale

0322

The last line of your linked story says it all, David. :D

"If they feel they should pay more in taxes, they can always right a check."

And THAT is what leaders do.. They LEAD...

If they feel that it's the right thing to do, then why aren't they doing it??

Because they are not leaders..

Like I said.. Clean the Dem House first.. Have them blaze the trail so that others will follow..

Until then, they have NO MORAL foundation to preach to the rest of us...

Michale

0323

http://www.theblaze.com/stories/yet-another-warren-buffett-owned-company-sued-for-tax-evasion/

Besides, Buffett IS guilty....

Like most rich people, Buffett games the system right up to the border of illegality and sometimes crossing the border...

"Peter?? Oh, he was borderline for a while. Then he crossed the border."

-Egon, GHOSTBUSTERS II

:D

Yer hearts in the right place, David. Of that I have absolutely NO doubt...

The problem is that the leaders you put your faith in are as corrupt and soul-less as those you oppose.. Difficult to win...

"If you storm in there and a hostage get's killed, yer damned. If you storm in there, free the hostages and kill all the terrorists... Yer damned... Difficult to win."

"Nature of the beast"

-THE FINAL OPTION

Michale

0324

Ya know what really chaps my ass about Democrats?

Ya know what really chaps my ass about conservative news?

Making stuff up.

Have them blaze the trail so that others will follow.

Taxes aren't voluntary. You don't "lead". But I'll tell you what, Michale. The minute conservative politicians start saying that they will be the first ones on the front lines in a war, I might consider your view anew.

-David

Besides, Buffett IS guilty....

Doesn't this contradict your previously stated conviction of innocent until proven guilty?

Or does this only apply to certain people?

BTW- Consider the source. If any of this has any merit beyond pure made up BS, why isn't any of this in actual news?

-David

p.s. Oh yeah ... right. Square one. The "liberal media".

Isn't it great that you can make up anything in conservative news and then when people ask why no real papers are reporting on it, you can just claim the media is "liberal"?

Ya know what really chaps my ass about conservative news?

Making stuff up.

But it DOESN'T chap yer ass when Leftist news makes stuff up..

How come??

:D

Taxes aren't voluntary. You don't "lead". But I'll tell you what, Michale. The minute conservative politicians start saying that they will be the first ones on the front lines in a war, I might consider your view anew.

It's not the Conservative Politicians agenda...

Democrats are the "taxes will solve all the problems"animals in this..

So, let them lead...

Why do you have a problem with Democrats practicing what they preach???

Michale

0325

Doesn't this contradict your previously stated conviction of innocent until proven guilty?

It does indeed...

Or does this only apply to certain people?

In a way... I always assume that the grotesquely rich have HAD to have screwed SOMEONE over on their way to the top...

The difference between me and everyone else here is I apply that FAIRLY to all rich people..

Ya'all only apply to Republican rich people..

Just like I slam ALL politicians at one time or another..

Ya'all only slam Republicans and, by and large, give Democrats a pass...

Our illustrious host, of course, is the exception that proves the rule..

Now, pardon me while I wipe this brown stuff off my nose.. :D

Just once I would love to see rank and file Weigantians slam the Democrats as much as I slam Republicans...

Consider that on my bucket-list :D

Michale

0326

Isn't it great that you can make up anything in conservative news and then when people ask why no real papers are reporting on it, you can just claim the media is "liberal"?

Do you HONESTLY consider TheBlaze to be MSM???

Using those standards, we would have to start adding HuffPo, DailyKos, FireDogLake, etc etc etc to the standards of MSM..

Then, the Leftist Bias of the MSM becomes even MORE pronounced.... :D

Michale

0327

The difference between me and everyone else here is I apply that FAIRLY to all rich people.

Yes. We know. You want all rich people to have special privileges and exemptions. You are the Robin Hood of the rich.

Just once I would love to see rank and file Weigantians slam the Democrats as much as I slam Republicans.

Really, Michale. Just once? Can you maybe stop making things up? People here take Democrats to task all the time.

For instance, Chris here on tax breaks. As I've done on healthcare. As I've done on Obama's negotiation tactics. As I've done on his campaign. As we all do pushing Democrats to act more like ... well, liberals ... Etc, etc.

We just don't do it with made up Limbaugh birther, Benghazi, Buffett, Beck, DailyBlaze nonsense.

So you can check that one off your bucket list. Also, I have to say you need a new bucket list if this is on it :)

-David

http://www.youtube.com/watch?v=u_F3oev06i0&feature=youtu.be

Democrats at their finest.....

Makes me embarrassed to be an American...

Michale

0328

Really, Michale. Just once? Can you maybe stop making things up? People here take Democrats to task all the time.

Somehow, I don't consider, "Yer not beating up enough on the Republicans!!!" or "Why do you always give in to the Republicans!!??" taking Democrats to task..

Why don't you slam them for their violence, their hypocrisy, there out and out meanness, corruption, bigotry, racism and all those other fun things ya'all just LOVE to slam the Right for???

NO ONE here even APPROACHES the condemnation towards Democrats that I do towards Republicans.

This is undeniable fact that NO ONE can argue...

For instance, Chris here on tax breaks. As I've done on healthcare. As I've done on Obama's negotiation tactics. As I've done on his campaign. As we all do pushing Democrats to act more like ... well, liberals ... Etc, etc.

Exactly.. You slam Democrats for not sticking it to the Right they way the Right sticks it to the Left..

Have you ever condemned Democrats for being BAD people, BAD Americans, BAD human beings!???

Nope...

Lets see you condemn Democrats for that YouTube video above...

Don't tell me.. Let me guess. Those weren't REALLY Democrats... :^/

Michale

0329

Imagine if Bruce Willis had said on SNL, "I am in a great movie!!! I get to kill all the black people. How awesome is that!??!" Yet, that's EXACTLY what Jamie Foxx said about white people and no one said dick...

i don't get the relevance to the topic of taxing the rich.

historically in movies the black person was among the first to die, and that stood in stark parallel to the real life marginalization and murder of african-americans, especially in the south. although the sentiment is not exactly original and at this point is somewhat outdated, i don't think it's necessarily racist to enjoy being in a film that reverses those antiquated cultural norms. on the other hand, it is almost certainly racist to explicitly advocate their return. different context, not hypocrisy.

as for democrats on the tax issue, certainly they don't have any semblance of moral high ground; they've been just as guilty as republicans of shafting the middle class and labor, all while preaching what big supporters they were of the middle class and labor. but you don't have to be honest or courageous to be right. whether or not they happen to have the stones to practice what they preach, the democratic position on progressive taxation is the right one for our country.

Do you HONESTLY consider TheBlaze to be MSM?

My mistake.

From TheBlaze

Bloomberg News reports that Buffett’s Berkshire Hathaway, owns an airplane company that has been sued by the Federal Government for no less than $366 million in back taxes.

Now I thought, according to you, the federal government under Obama wouldn't "go after one of it's own".

So you'll be willing to follow now right?

-David

David [5] -

Aha! That explains a lot. Thanks for the screen shot, too!

I got a call from my ISP at 8:00 at night, saying "your site is consuming 99 percent of all of our traffic right now, we're going to temporarily disable it."

I talked to the guy and we figured out it was coming from HuffPost, and wasn't a hack attack on the site or anything, but until I saw your comment I didn't really know what had caused it.

Thanks for pointing it out! They said they're going to move my site to a beefier server, in case it happens again.

That's pretty impressive, at least to me...

:-)

Thanks for clearing up the mystery!

-CW

That's pretty impressive, at least to me...

Me too! When I saw it, I about flipped. Well deserved!

-David

i don't get the relevance to the topic of taxing the rich.

It was relevance to the blatant double standards that chaps my ass... :D

as for democrats on the tax issue, certainly they don't have any semblance of moral high ground;

Too troo.... The problem is you are (with the exception of our illustrious (and not MORE famous) host) the only one who acknowledges this...

i don't think it's necessarily racist to enjoy being in a film that reverses those antiquated cultural norms. on the other hand, it is almost certainly racist to explicitly advocate their return. different context, not hypocrisy.

No, but it IS racist to articulate such enjoyment in such blatantly racist terms...

At least, IMNSHO

they've been just as guilty as republicans of shafting the middle class and labor, all while preaching what big supporters they were of the middle class and labor.

Yea, but to hear the rank and file tell it, Democrats are pure as the driven snow and it's all

the fault of the evil and soulless Republicans.

A little intellectual honesty goes a LONG way...

whether or not they happen to have the stones to practice what they preach, the democratic position on progressive taxation is the right one for our country.

Perhaps it is... But until, as you say, they have the stones to actually LEAD on the issue.... Well, we'll likely never know...

Michale

0330

David,

Now I thought, according to you, the federal government under Obama wouldn't "go after one of it's own".

SAYING they are going after Buffett and actually GOING AFTER Buffett are two distinctly different things...

When Obama's DOJ hauls away Buffett in chains... Come talk to me.. :D

Obama and the Democrats give GREAT lip service....

But when it's time for the rubber to meet the road???

Joe and Jane Sixpack are still getting screwed while the Soroses and Buffetts and Adelsons of the country get to sit back in their penthouses and drink pina coladas..

You want to apply the standard fairly, then apply the standard fairly... Don't demonize the Adelsons and the Kochs and give the Buffetts and the Soroses a pass...

That's all I ask...

Michale.....

0331

CW,

That's pretty impressive, at least to me...

It is, indeed...

Congrats, CW... It is well-earned..

Maybe your manner of holding BOTH SIDES of the aisle accountable will catch on...

Gods know it's needed!

Michale

032

Too troo.... The problem is you are (with the exception of our illustrious (and not MORE famous) host) the only one who acknowledges this...

That should read 'NOW more famous host'..

Sorry for the tortured punctuation... :D

Michale

0333

SAYING they are going after Buffett and actually GOING AFTER Buffett are two distinctly different things.

Hmmm ... It looks more like suing Buffett is the same as suing Buffett.

And you're bailing on your word that you'd follow Democrats if they'd lead.

Just sayin' :) Man up, man! I'll only hold you to sending a letter to your Republican representative stating your support for returning tax rates on the wealthy to more equitable levels.

-David

Great column but I wish you would have put some dollar figures to the proposals.

Treating all income as the same would seem to be a no brainer, especially if the first X dollars were exempt to protect the moms and pops.

Taxing programmed trading is another easy one. It is destabilizing and the whole idea of giving a select few even a 5 millisecond advantage de-ligitimizes the market. The churning of the market at increasingly unprecedented level benefits only the few and contributes nothing but instability.

Please Chris, do a follow up with credible numbers on your proposals. You are on to something and now is the time to get the ideas out there.

Michale [32] -

The one thing we do see eye-to-eye on when it comes to the general subject of torture is that punctuation, syntax, and grammatical rules-for-the-sake-of-rules are fair game to be tortured here.

Heh.

-CW

Hmmm ... It looks more like suing Buffett is the same as suing Buffett.

Yea??

And prosecuting Black Panthers for voter intimidation SHOULD be prosecuting..

But we know how THAT turned out, right?? :D

I'll only hold you to sending a letter to your Republican representative stating your support for returning tax rates on the wealthy to more equitable levels.

Not until I see Democrats applying the standard fairly.

Until then I won't lift a pinky to help them screw over the middle class...

AGAIN...

Michale

0334

The one thing we do see eye-to-eye on when it comes to the general subject of torture is that punctuation, syntax, and grammatical rules-for-the-sake-of-rules are fair game to be tortured here.

"Strange Times"

-Dean Winchester, SUPERNATURAL, Appointment In Samarra

:D

Michale

0335

Dems Ask For Delay In Tax They Voted For

http://www.atr.org/dems-delay-obamacare-med-device-tax-a7380

Hmmmmmmmm

That seems almost as funny as a Republican filibustering himself..

"Laugh it up, Fuzzball(s)"

-Han Solo, THE EMPIRE STRIKES BACK

:D

Michale

0337

http://www.bloomberg.com/news/2012-12-11/-822-000-worker-shows-california-leads-u-s-pay-giveaway.html

As California goes, so goes the rest of the country..

Under Democrat "leadership", that is...

The evidence is clear. The Democrat way does NOT work...

Michale

0338

Not until I see Democrats applying the standard fairly. Until then I won't lift a pinky to help them screw over the middle class.

Let's be honest. Seeing Democrats applying "the standard fairly" wouldn't change your mind about helping.

But that's ok. We'll fight for you without you. You'll be missed and I mean that sincerely because I'd much rather fight with you.

I'm just glad we all seem to agree that there shouldn't be special tax breaks (or special anything for that matter) for the wealthy. Buffett is the last person who needs any help :)

-David

Let's be honest. Seeing Democrats applying "the standard fairly" wouldn't change your mind about helping.

Abso-tively and posit-loutly it will..

When I see Democrats acting like civilized human beings in condemning the actions, such as illustrated in comment #23, when I see Democrats applying their rules FAIRLY to everyone, regardless of their political affiliation, then I will gladly support their efforts that are in the best interests of the country..

But I refuse to support "leaders" who's FIRST allegiance is to Party and all other considerations are secondary...

This "Party Uber Alles" mentality has GOT to go..

Period.

I'm just glad we all seem to agree that there shouldn't be special tax breaks (or special anything for that matter) for the wealthy. Buffett is the last person who needs any help :)

Exactly.. And same with Adelson..

So, when Obama has Buffett and Soros in front of a judge in court rather than at the White House for tea, I'll believe he and the Democrats are serious about their desire to help the Middle Class...

Michale

0339

And now for a comical interlude.

Little Jimmy's Letters To Santa

Dear Santa,

How are you? How is Mrs. Claus? I hope everyone, from the reindeer to the elves, is fine. I have been a very good boy this year. I would like an X-Box 360 with Call of Duty IV and an iPhone 5 for Christmas. I hope you remember that come Christmas Day.

Merry Christmas,

Jimmy Jarvinen

* *

Dear Jimmy,

Thank you for you letter. Mrs. Claus, the reindeer and the elves are all fine and thank you for asking about them. Santa is a little worried all the time you spend playing video games and texting. Santa wouldn’t want you to get fat. Since you have indeed been a good boy, I think I’ll bring you something you can go outside and play with.

Merry Christmas,

Santa Claus

* *

Mr. Claus,

Seeing that I have fulfilled the “Naughty vs. Nice” contract, set by you I might add, I feel confident that you can see your way clear to granting me what I have asked for. I certainly wouldn’t want to turn this joyous season into one of litigation. Also, don’t you think that a jibe at my weight coming from an overweight man who goes out once a year is a bit trite?

Respectfully,

Jim Jarvinen

* *

Mr. Jarvinen,

While I have acknowledged you have met the “nice” criteria, need I remind you that your Christmas list is a request and in no way is it a guarantee of services provided. Should you wish to pursue legal action, well that is your right. Please know, however, that my attorney’s have been on retainer ever since the Burgermeister Meisterburger incident and will be more than happy to take you on in open court.

Additionally, the exercise I alluded to will not only improve your health, but also improve your social skills and potentially help clear up a

complexion that looks like the bottom of the Burger King fry bin most days.

Very Truly Yours,

S Claus

* *

Now look here Fat Man, I told you what I want and I expect you to bring it. I was attempting to be polite about this but you brought my looks and my friends into this.

Now you just be disrespecting me. I’m about to tweet my boys and we’re gonna be waiting for your fat ass and I’m taking my game console, my game, my phone, and whatever else I want. WHAT EVER I WANT, MAN!

T-Bone

* *

Listen Pizza Face, Seriously??? You think a dude that breaks into every house in the world on one night and never gets caught sweats a skinny G-banger wannabe?

“He sees you when you’re sleeping; He knows when you’re awake”.

Sound familiar, genius? You know what kind of resources I have at my disposal. I got your shit wired, Jack. I go all around the world and see

ways to hurt people that if I described them right now, you’d throw up your Totino’s pizza roll all over the carpet of your mom’s basement. You’re not getting what you asked for, but I’m still stopping by your crib to stomp a mud hole in your ass and then walk it dry.

Chew on that, Petunia.

S Clizzy

* *

Dear Santa,

Bring me whatever you see fit. I’ll appreciate anything.

Jimmy

* *

Jimmy,

That’s what I thought you little bastard.

Santa

:D

Michale

0340

Great post CW, I'm not surprised it is getting a lot of hits as it accurately sums up a lot of problems in the tax system. Here are a few additions I would add that you might consider for future discussion ;):

- Tax avoidance/evasion is huge all over the world (see 47%-guy), including America obviously. In fact, it is so huge that all this $ in lost taxes is worth almost as much as ALL ENTITLEMENT SPENDING PUT TOGETHER. Think about that in the context of the current deficit discussions and Republican's laughable attempts to construe entitlement spending as your nation's problem.

- Obama wants to raise taxes only on those earning $250k. So basically if you're earning $100-250k you are deemed to be 'struggling' and in need of a tax break. LOL. Again, not something that I see being discussed anywhere. As someone who knows quite a few tax systems, you'll find it hard pressed to find a country where their income tax rates are so low on people earning $100-250k.

[Ed. note: I'm having problems replying on this thread, but wanted to paste this link in:

http://www.chrisweigant.com/2008/04/17/debate-observations-what-exactly-is-middle-class/

Comment to follow. -CW]

So basically if you're earning $100-250k you are deemed to be 'struggling' and in need of a tax break.

"Look, I know that five million a year sounds like a lot of money. But I gotta pay ten percent to my agent, five percent to my lawyer, plus alimony, child support...."

"You got any idea what insurance on a Ferrari costs, motherfu...."

-The Replacements

:D

Michale

0340

Haha v nice Michale!

More evidence of MSM Left-Wing Bias...

Why aren't any of the MSM reporting of the Union violence in Michigan???

Michale

0341

Speaking of Left Criminals that walk free...

Why hasn't Jon Corzine been hauled away in chains??

Why isn't the IRS crawling up Corzine's ass???

Oh that's right...

He has that '-D' after his name and he is an Obama supporter...

So, of course, he goes free..

What was I thinking......

Michale

0343

Not only is Corzine a free man after stealing over a billion dollars.....

http://www.zerohedge.com/news/jon-corzine-will-not-only-not-face-prosectuion-may-be-launching-hedge-fund-imminently

He is free to start a NEW Hedge Fund!!

So, tell me again how Democrats will clean up their own house and we can trust them with our money....

Michale

0344

In summation...

I completely and unequivocally agree with CW and the title of this commentary..

Tax ALL the rich...

NOT just the rich that have the '-R' behind their name...

Prosecute ALL the rich...

NOT just the rich that have the '-R' behind their name...

Democrats start doing that and they might be worthy of my vote...

Michale

0345

michty6 [43] -

OK, sorry for hijacking your comment. I'm still having computer problems occasionally...

Which reminds me, our pledge drive shot up immediately to over half our goal, but has since stagnated, no new donations in a week. Hint, hint. Sigh.

Your point about $100-250K is a good one. The link I pasted in your comment traces the origins of this pledge. The article's a bit long, was reviewing the final debate in the primary season of 2008 between Hillary and Barack, and I am more interested in ripping a new one in the idiocy of the moderators, but still...

Anyway, at the time I predicted "this pledge will come back to bite them" meaning Obama and Clinton, whichever won.

Since this time, though, it's been pointed out to me that the $100-250K income range is exactly the fattest target of politicians seeking donations. Over that range, they're in a small and very exclusive category, but from 100-250K are folks who have the resources (and the motivation) to drop the maximum campaign donation of a few thousand bucks, each and every election cycle.

This may be over-cynical, but this may be one reason why Obama joined Hillary's pledge to draw the "we won't tax anyone below this" line at $200K (individual) and $250K (married). And why, ever since, it has stood for the limit on "the middle class".

Obama even once advocated changing the cap on SS income. His plan? Keep the 6.2 percent up to the current cap, then have a 0.0% rate for 100K-250K, then after $250K return it to 6.2%. You can see how slanted this is towards a very specific group of people, no?

Anyway, follow that link, scroll down to the second (I think) interview quote section, and my relevant comments are below it. Sorry for the piecemeal nature of my response, too.

-CW

newsboy [34] -

First off, welcome to the site! Sorry for the delay in posting your first comment, from now on you'll be able to post instantly here, as long as you don't post more than one link per comment (these are filtered automatically to avoid comment spam).

You raise a good point. I don't have the resources available to calculate the numbers on my own, but most of these proposals are already out there, and with a little online research I could probably at least come up with rough numbers which showed the magnitude of each suggested change.

Let me look into it. I can't promise a column with all the numbers before the fiscal cliff, but you do indeed have a great suggestion, worth following up on.

-CW

newsboy,

Let me be the second to welcome you to CW.com!

And, that is a great idea about the adding some numbers.

But, even without the number, this was an excellent column by Chris and I was happy to see you write that he is on to something - I thought exactly the same thing after I read it.

Maybe what we all need to do is cut and paste the link and, along with a brief explanation, send it to wherever it may do the most good to get this piece out there and into the national conversation.

Any suggestions?

CW [50]

Yeh for comparison purposes, the 'upper' rate for tax in the UK kicks in at £34k (about $50k). Above this you're charged 40%. Then there is a newish tax rate above £150k (about $225k) that you'r charged at 50% above (dropping to 45% next year - good old Tories!).

In Canada, the rates increase at $42k, then $84k then $130k.

So basically above $50k in the UK, you are considered a 'high earner' and above $225k you are considered a 'super high earner'; in Canada above $84k you are considered a 'high earner' and above $130k a 'super high earner'.

The income tax rates you pay in America are just unbelievably low in comparison, especially for those earning >$50k. Basically the rate Obama wants to put in at $250k is what we pay in the UK at $50k and Canada pays at $84 (slightly depends on Province in Canada though).

And what makes it worse is that it is a FIGHT for Obama to get it as 'high' as $250k!!!!