Guest Column -- Lessons For Mr. Romney From The U.K. And Europe

[Program Note: Today we present the second of our guest columns, and heartily encourage more people to send these in so we can run them. Today's column was actually submitted a week ago, so the gap in relevance is entirely the fault of this website, and not the author. Americans are for the most part unaware of how the rest of the world sees them, and both the Olympics and Mitt Romney's visit overseas opened up a window into some of this worldwide opinion. Our guest author today ("An Arrogant Brit") not only sheds some light on this, but also makes several excellent points about what America could learn from the rest of the world, as well. Enjoy, and if you've been thinking about submitting one of these columns... whatever are you waiting for? Type it out and send it in today!]

-- Chris Weigant

Lessons For Mr. Romney From The U.K. And Europe

Day One of Mitt Romney's foreign trip did not go particularly well. He learned first-hand that no country likes an arrogant American coming in to tell them how bad a job they're doing, regardless of how special the "special relationship" is.

"We are holding an Olympic Games in one of the busiest, most active, bustling cities anywhere in the world. Of course, it's easier if you hold an Olympic Games in the middle of nowhere." [emphasis added]

A slap-down of this nature from a fellow "Anglo-Saxon" Conservative party leader is embarrassing. Even more so was the Conservative Mayor of London mocking Romney and getting the crowd to chant the old Obama slogan "Yes We Can!"

Not the start that the would-be "President Romney" imagined to his first big foreign adventure. However, I believe this trip can still be salvaged for Romney. He can learn a lot from the U.K. and, in the same manner of Romney himself, I would like to present an arrogant British person telling Mr. Romney exactly what America can learn from the U.K.

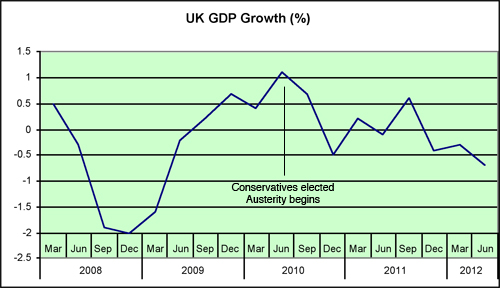

On July the 27th, it was announced that GDP growth in the U.S.A. was a "disappointing" 1.5% for Quarter 2 (ending June 2012). If Americans are disappointed, then Mr. Romney should have taken a look around him in London where Quarter 2 in the U.K. saw GDP growth of negative 0.7%, following two previous quarters of negative growth. "Disappointing" doesn't get close to describing the U.K. economy; "disastrous" would be more adequate.

If Romney is smart, instead of being bored by his wife's horse dancing competition, perhaps he can sit and ponder this question: Why on earth would two similar countries, hit equally hard by the recession, have such contrasting GDP growth and recovery success rates?

Well Mr. Romney, the answer is simple: in 2010 the U.K. elected a Conservative Government. The U.K. Conservatives came to power on the promise of cutting taxes on the rich "job creators," massive public spending cuts, and de-regulation and other business "incentives" to boost the economy. Sound familiar at all?

The results have been horrific. In fact if you look at the graph of U.K. GDP growth (the U.K. reports GDP growth quarterly and GDP annually) you can actually pin-point the precise point where the Conservatives took over:

[Source graph, cross-referenced to U.K. government quarterly GDP releases.]

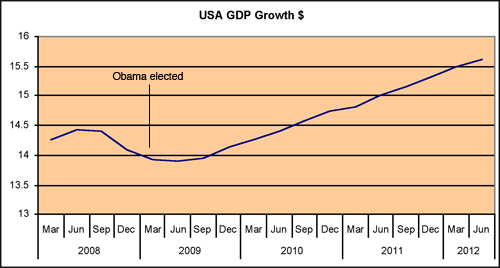

Contrast this to America which, since the recession hit its peak in the middle of 2009, has only seen periods of GDP growth and is only expecting to see further periods of growth. American GDP is not flying away, but it is steadily climbing:

[Source graph, cross-referenced to World Bank data.]

Whatever America is doing, it is working. And it is working drastically better than in Europe -- the American recovery is faster than anywhere in Europe and fastest among any country that was affected as deeply as they were by the recession (those, for example, which required bank bailouts). It might be slow and steady but compared to the stuttering and suffering from Europe and elsewhere it is considerably better.

So, Mr. Romney, if you want to take anything from your trip to Europe and to the U.K. (aside from learning the importance of not shooting off your mouth), I hope you take one more considerable and important thing: Austerity does not work, and your economic policies would be an absolute disaster for both the American and world economic recoveries.

The next election is huge -- a choice to continue the recovery under Obama, or change path and go the same way as Europe. If America doesn't wake up and realize this soon, your short time as the world's No. 1 economic superpower is going to be cut considerably shorter.

Signed,

An Arrogant Brit.

Follow Chris on Twitter: @ChrisWeigant

Some of the regulars here might have guessed, but in case you haven't, this was me :)

Thanks for posting this CW - like Chris pointed out I sent this to him while Romney was actually in the UK but it is very relevant regardless.

I'd say the same thing that I said to CW - I'd really appreciate any criticisms in any way shape or form - not just on the content but the writing style and such as I am new to writing blogs but it is something I am interested in doing...

It's OK, Michty.

We all knew it was you :) The big question is how many comments you'll get from the Rabid Right, and your personal nemesis, the BLACK HOLE. I'm guessing 50+; less if you don't waste breath responding to BLACK HOLE'S jibberish. Good Luck. I was hoping for a longer piece from you, as you're a welcome intelligent voice to this site :)

Haha thanks Kevin. I wanted to keep it concise and simple since, as far as I'm concerned, anyone could easily see that austerity doesn't work ;)

Even Romney hints at times that he knows this (http://www.huffingtonpost.com/william-k-black/romney-austerity_b_1545454.html) but the extreme right in his party then pull him back in and now even Mr 'Austerity' Ryan is a viable candidate for VP!

The article came from an idea when I was looking at UK GDP and saw how bad things have been since the Torys took over.

I am trying not to respond, it is a work in progress but I'm getting there!

Contrast this to America which, since the recession hit its peak in the middle of 2009, has only seen periods of GDP growth and is only expecting to see further periods of growth. American GDP is not flying away, but it is steadily climbing:

The only thing I see steadily climbing is the national debt.

I have a huge amount of empathy for you. My first girlfriend and love of my life was British, and I spent a month there in 1973. My mother's family was SO British, so I have an abnormal amount of Englishness in my background...As an Internet "friend", please waste minimal time of your precious life dealing with the BLACK HOLE'S inevitable nonsense.

Even more so was the Conservative Mayor of London mocking Romney and getting the crowd to chant the old Obama slogan "Yes We Can!"

Was that the same mayor who got stuck on the not-so-well-organized zip wire?

OK, gang, let's stop with the blatant insults.

C'mon, people, all I asked for was a month of Tuesdays and Thursdays (to say nothing of the weekends) where I didn't have to referee here quite so much. I've been spending hours today squinting at PDF images of newspapers from the 1780s, and the bickering back then is quite enough, thanks.

So, let's go back to our corners for a bit, here.

Kevin -

Stop calling people names. I hear your frustration, but you're crossing a line. Cut it out.

If any commenter is too annoying, the cruelest thing you can do is to ignore them. This goes for EVERYbody, not just Kevin, by the way.

Chris1962 -

You are frustrating a lot of people here by your tactics. You make assertions, people provide info to refute them, and you almost universally then reject all sources of info that you deem unacceptible. This may score points elsewhere, but here it is getting tiresome.

This is a reality-based blog. I'd also be the first to admit that it is a whole lot more Lefty than anything else, although not dogmatically so. But that's the purpose, and that's the intended audience.

If you pick a fight, you're going to provoke reactions. There's a way to gracefully end a thread when you know neither of you is going to convince the other, even if you don't concede a point.

Why not put the shoe on the other foot? I challenge you publicly to write an article for next week laying out a different scenario than the one I outlined in my most recent Electoral Math. I know you respect polling data, so here's your chance. Look into your crystal ball, and lay out a path (or as many paths as you'd like) for Romney to achieve victory in November in the EC. How do you count to 270, in other words? I heard one today which made me blink, so here it is (from a HuffPost comment, I think): Romney wins WI, NH, CO, VA, IA, and FL -- and thus wins without OH or PA or MI. Whaddya think (OK, I did that from memory, might have gotten one of those wrong -- check the HuffPost comments to see the real list -- it made me think when I read it because it seemed pretty plausible).

But seriously -- sit down, type out 1 to 3 pages on how you see the race shaping up, once everyone starts paying attention after the conventions. Shoot it off to me in an email. I promise I'll print it.

Then perhaps you can see what it's like defending, instead of playing offense. I think it'd be healthy for everyone.

Anyway, like I said, guys, we've got a long way to the election, and I promise you can let all the fur fly you want once the conventions start. Just PLEASE give me a few weeks of relative peace to put the final touches on the book project I'm working on.

I love interacting with commenters, and I simply have not been able to engage fully with it while focusing on finishing this project. I will return here in the comments when necessary, and I still read every comment written.

But it takes time to write these comments out -- as each and every one of you is fully aware. This time steals time away from what I'm trying to do this month.

So let's all take a deep breath, and try to get through the dog days of August in one piece, shall we? I know it's an election year, and things are heating up all over. But, like I said, we'll have plenty of time for that in the fall.

-CW

To Everyone:

For the first time I can remember, I have just begun deleting comments I deem to be nothing more than personal bickering.

This is a sad day, for me.

But (see above) I just don't have time to hand-hold this month. So I am going to use this tactic all month long. If your comment is deemed unacceptible, it's going to go away.

Note: I will be watching this Friday's comments much closer than I have been, as this seems to be the free-for-all each week.

You have been warned. I don't have time for this, and deleting is quick and easy.

-CW

Here's one quote from the notes I wrote today. This was during the debate over the Constitution and the necessity of the Bill of Rights, waged by Federalists and Antifederalists. From October 20, 1787, responding to a recent pamphlet (it doesn't even matter which side this guy's on, both sides were equally as scathing, unlike the sober essays in The Federalist Papers would have you believe):

"The author, who from his notes, appears to be but little removed from idiocy, has, under the guidance of instinct, supressed his name, and published without a signature....How a booby of this blunted comprehension should have been betrayed into the lists of political controversy, is truly astonishing..."

Plus ca change, plus ca meme chose, and all of that...

Hrrmph.

-CW

Something additional to note for the article that I included when I sent it to CW:

I included sources for the graphs in the article but (as someone who takes sources and data seriously) I think I should explain why they are based on different data (not sure if anyone noticed this).

The UK updates actual GDP by $ annually. But it updates GDP growth rates in % quarterly. America actually updates GDP quarterly but monthly figures are filed with the World Bank. So I chose to use GDP growth in the UK once I saw the particular stunt after the 2010 election, and GDP in America as I feel it shows how steady things have progressed since Obama's election and the dip right after it...

GDP in America as I feel it shows how steady things have progressed since Obama's election

The argument is that it's not growing at the rate it can and should be, not that it isn't growing at all. It's simply dragging along at a snail's pace. And the Right's solution is to free up job-creators' costs — particularly small businesses — so that their money can go into expansion and hiring instead of the federal government's pocket. Taking money away from job creators is no way to inspire job creation. That's the difference in attitude and approach between the two parties.

Another thing the Right takes into consideration is the "confidence" job creators need in order to take risks in this lousy economy. Obama and the Left seem utterly blind to this. Business owners need to be able to create 3-year/5-year/10-year business plans. So giving them a 2-year tax extension, and threatening to raise their taxes (i.e., take that much more money away from their business) does nothing in the way of inspiring them pour their collective cash-trillions back into the economy, which they've been sitting on for a couple of years.

And I suspect they're gonna remain sitting on those dollars until Obama is out of the White House.

"The argument is that it's not growing at the rate it can and should be, not that it isn't growing at all. It's simply dragging along at a snail's pace. And the Right's solution is to free up job-creators' costs — particularly small businesses — so that their money can go into expansion and hiring instead of the federal government's pocket. Taking money away from job creators is no way to inspire job creation. That's the difference in attitude and approach between the two parties."

Sure I get the argument, it's the same Trickle Down economics argument that has been failing since 1980. America has tried it and it has failed - even Obama gave it a chance - do you recall that he hasn't raised taxes and actually extended the Bush tax cuts? If the recovery isn't 'growing at the rate is should be' just now with tax rates low, then perhaps it is time to try something else? I am definitely considering writing an article about the myth of Trickle Down...

The money would be much better used to be put in the hands of the people - demand side economics rather than Trickle Down. This was the idea behind Obama's stimulus and this is why as noted in the article: American recovery is faster than anywhere in Europe and fastest among any country that was affected as deeply as they were by the recession (those, for example, which required bank bailouts). The difference between America and the UK was Obama went with Stimulus, the UK went with austerity.

The other thing you miss is that America has a large deficit. So if you cut taxes (revenue) of those at the top, you have to make up for this with increased taxes on everyone else accompanied with austerity. The whole point of the article is that austerity doesn't work. And, as Obama's campaign team is pointing out, now is not the time to give the top a tax cut whilst passing on higher taxes to everyone else.

"Another thing the Right takes into consideration is the "confidence" job creators need in order to take risks in this lousy economy. Obama and the Left seem utterly blind to this. Business owners need to be able to create 3-year/5-year/10-year business plans. So giving them a 2-year tax extension, and threatening to raise their taxes (i.e., take that much more money away from their business) does nothing in the way of inspiring them pour their collective cash-trillions back into the economy, which they've been sitting on for a couple of years.

And I suspect they're gonna remain sitting on those dollars until Obama is out of the White House."

I agree with you on confidence. It is very important and lacking just now.

The thing is you actually mention what is going on but are blind to why this disproves your argument. Like you said businesses ARE sitting on cash. This is because Obama extended Trickle Down. But they are not investing it (and certainly not investing it America). And yes the reason for this is confidence but this confidence has nothing to do with income tax rates - this idea is laughable.

The idea that income tax rates affect the investment decisions of business is one of the biggest myths of Trickle Down. I work in finance - there is absolutely no financial model to analysis an investment potential that looks at income tax. None. Corporation tax and other business taxes, sure. Income tax never.

The reason confidence is low is because nobody has confident in Europe - America (and the UK's) number one trading partner. If you follow the markets you will see almost every single day the markets go up or down based solely on the news from Europe (and lately you can almost correlate the confidence of the market to Spanish bond yields). The level of confidence has absolutely nothing to with income tax rates. In the UK income tax rates have already been cut and there are no proposed changes to them. Yet confidence there (and everywhere else in the world) is low just now.

You are frustrating a lot of people here by your tactics. You make assertions, people provide info to refute them, and you almost universally then reject all sources of info that you deem unacceptible.

I personally reject "studies" that are funded, conducted, analyzed, and summarized by self-interested parties, for brutally obvious reasons, Chris, i.e., just as polls can be crafted to produce a desired result, so also can "studies" with strategic agendas behind them. Trust me: I've created plenty of them for clients seeking to give a misleading (albeit legal) impression to the public that their product or service has superiority, or offers more credible "reason to believe," than their competitors'. And I can smell one of those "studies" from a mile away. A perfect example is the famous ongoing "study" of LGBT parenting. If one takes the time (as I have) to look into the financing and methodology, they'll quickly find that the study is funded by gay organizations. And if you look at the bios of the actual researchers, who crafted the methodology, conducted the study and (key) drew the favorable conclusions, you'll discover that they're gay, too. So that type of self-interested "study" has no credibility, in my personal opinion. And that's why I reject tainted, self-serving "studies" when they're offered up as "fact." They're not "fact" but spin, using the same tactics writers use when they wish to spin poll results.

As for statistics — another handy spin tool, as writers know only too well — they're flat, averaged-out, per capita numbers that do not offer anything in the way of actual, practical, situational, cause/effect reality. By way of example, broad, sweeping, averaged-out numbers on the topic of white/black imprisonment don't take into account such realities as socio-economic conditions, gang presence and participation, illegal drug/weapons use, mandatory sentencing, lengths of sentences, or even so much as repeat offenses, which can neatly land a body in prison in a NY hurry. So statistics alone do not serve as "proof" that blacks are being unfairly incarcerated, or at any greater rate than they should be. The "reason why" exists in the breakdowns, not in the flat numbers.

That's my personal view and personal opinion regarding the use of broad-sweeping "statistics" and desired-effect "studies" as a means of providing so-called "proof" that one's position — or opinion, as is most often the case — is rock-solidly inarguable. Statistics are measures, devoid of "reason why." So in a discussion regarding "reason why" — and just so folks don't get "frustrated" anymore — that's my reaction and response whenever I'm presented with a breakdown-free statistic or desired-effect study that's being misused, or in a misleading manner, with the ultimate goal of dismissing the other side's views and rendering a discussion case-closed. There's always a great deal more to the story than flat, conveniently averaged "statistics" reveal; and that's not to mention strategically crafted "studies," the authors of which are constantly being busted for their blatant, deliberate use of spin tactics and devices so as to achieve precisely the result they were shooting for, from the get-go.

the same Trickle Down economics argument that has been failing since 1980.

In your opinion. Trickle-down has never occurred on its own, without a rise of government spending, so it's impossible to determine whether its failed.

f the recovery isn't 'growing at the rate is should be' just now with tax rates low, then perhaps it is time to try something else?

Like creating confidence for job creators? I'm afraid that's gonna require a different president, as this one is dedicated to keeping small business owners at a standstill, with no clue of what their taxes are even gonna be a year from now, much less three, five or ten years down the road, and with no clue of whether, or when, their industry is gonna be hit with more regulations.

This was the idea behind Obama's stimulus and this is why as noted in the article: American recovery is faster than anywhere in Europe

America isn't Europe. And Obama's stimulus, by its own measure, did not achieve its goals. Unemployment is supposed to be around 6% right now, according to O's master plan. Only it's just ticked UP to 8.3% — a higher rate of unemployment than when he took office.

Like you said businesses ARE sitting on cash. This is because Obama extended Trickle Down.

No, it's because, despite extending the tax cuts, O can't seem to open his mouth without assuring job creators that their taxes are gonna go UP. And since that's all dependent upon which candidate wins the election, and what kind of congressional makeup emerges, business owners — particularly small business owners — are left with little choice but to "wait and see," considering they can't even put together a marketing plan, much less craft or implement a long-term business/growth plan. They don't even know if they're gonna be able to afford CrapCare, or whether it makes better financial sense to drop their programs, or whether CrapCare is even going to exist, depending on which candidate takes office in November. Obama couldn't have created more uncertainty for business owners if he tried.

The other thing you miss is that America has a large deficit.

And a brand-new, first-time-ever downgrade. And that $15.6T (and growing) debt doesn't exactly do wonders in terms of building confidence, either. Tune into any business channel and hear all about it.

So if you cut taxes (revenue) of those at the top, you have to make up for this with increased taxes

Or increased revenue, which comes from employed Americans paying taxes instead of collecting food stamps and unemployment. Increasing taxes on small business owners not only deters their ability to expand and hire but encourages BIG business owners to conduct business elsewhere, and for the super-rich to move their assets to a friendlier country. I think France is about to run into that problem: http://www.nytimes.com/2012/08/08/business/global/frances-les-riches-vow-to-leave-if-75-tax-rate-is-passed.html?_r=1&pagewanted=all&src=ISMR_AP_LO_MST_FB&pagewanted=all

I challenge you publicly to write an article for next week laying out a different scenario than the one I outlined in my most recent Electoral Math. I know you respect polling data, so here's your chance. Look into your crystal ball, and lay out a path (or as many paths as you'd like) for Romney to achieve victory in November in the EC.

Just so you know, I passed on your original invitation to the board because I write for a living, Chris. So writing a blog article is about the last thing I'm dying to do on the heels of writing a blog article for a client, or when I have downtime between projects, or when I'm not working on my own personal projects. So I'm gonna take a pass on your challenge for the same reasons, but also for the reason we discussed following your last Electoral Math article: I just think it's way too early in the game.

For all I know, Reagan Democrats could rear their not-so-ugly heads in November, or this dead-heat race can turn into a complete disaster for Romney. I'm looking at dead heats in states that Obama carried with no problem; plus, key battleground states bouncing back and forth between O and Romney, week to week. And what about "undecideds," who traditionally go for the challenger? And what about the introduction of a veep running mate, who could lock up a battleground? Or a female running mate, who could take a God-only-knows-what percentage of the female vote away in this or that battleground? Or a Hispanic/Latino running mate, who could do the same with that bloc of voters?

And what about turnout? O is doing really well with the youth vote, and minorities. Only, historically, they're the toughest groups for Dems to turn out. (They didn't exactly come riding to the rescue in 2010.) And let's not forget that O is no longer the sensation he was in 2008, with no record to speak of. And voter enthusisam is higher for Republicans than Dems this time around. So who the heck can know, at this point in time, whether O is gonna get anywhere near the turnout that went down in '08?

And while O has completed his initial advertising blitz, Romney is only now going in on O's heels. And Romney's blitz isn't even scheduled to begin until after the Olympics.

Truly, I wouldn't even know where to begin guessing at what November might bring. It's just too early for me to make any semblance of an educated guess as to which way the wind will ultimately blow in any of these battlegrounds. Best-case scenario? Reagan Democrats come out. Worst-case scenario? O sweeps it by a landslide. Bizarre-o scenario? One or the other wins the electoral college but loses the popular vote. That's really the best I can offer at this juncture. I applaud you for Electoral Math articles, though. I love reading them. But I just never get involved in counting electorals, myself, until after the conventions, and after the "bounces" have presented themselves — or not.

Nice piece. I hadn't even been aware that European austerity measures included tax cutting and trickle-down. Obviously I'd only been paying superficial attention to the details. I'd just assumed austerity meant tax increases and reduced spending. It never even occurred to me that wishful-thinking as fiscal policy might not be simply an American aberration. Now I understand why there's a growing call to reject austerity measures.

Chris

"In your opinion. Trickle-down has never occurred on its own, without a rise of government spending, so it's impossible to determine whether its failed."

Sure, could you explain your logic as to why this statement proves that my premise that trickle down has failed is incorrect?

I'd say it goes hand in hand - the Government has to increase spending because trickle down is such a large hand-out to the wealthy and is so detrimental to the economy and wealth generation for society that it inevitably leads to higher Government spending to counter this.

Chris

The rest of your argument has one major flawed assumption - thinking business investment decisions (thus business confidence) have anything to do with income tax rates.

I already responded as to why there is a confidence crisis in business. It has considerably more to do with Spanish bond yields than income taxes! Income taxes are applied AFTER the bottom line; investment decisions are made based on the bottom line. The idea that income taxes affects investment decisions is laughable! Speak to someone (else) who works in finance or look at any investment assessment model (eg. NPV, EV models).

If you truly believe this then I have some advice for you - if someone comes to you tomorrow and says "I have a business investment that is guaranteed to make you $1m bottom line, are you in?" don't say "I don't know, I'm not sure what my tax rate will be in 6 months..." instead shake hands with him so hard you snap his hand off :)

LD

Almost everywhere in Europe that had elections went considerably left during 2012 after the many failed attempts at austerity - so at least they learned their lesson: France, Italy and Spain saw heavy socialist wins; in Germany and Greece left-wing parties gained too. It's a shame that in the UK we have a fixed election which isn't until 2015, so we have no chance to end the Conservative austerity and tax cuts until then. Going to be a long, long 3 years for people at home. Sigh. Take this as a lesson for how important your upcoming election is.

Sure, could you explain your logic as to why this statement proves that my premise that trickle down has failed is incorrect?

One need look no further than wiki for that very basic fact. Economists have been arguing about it for years, and to this day, it's unresolved.

I'd say it goes hand in hand

Well, that's your opinion, to which you're perfectly entitled. But it doesn't dismiss the fact that trickle-down has never been tested on its own.

The rest of your argument has one major flawed assumption - thinking business investment decisions (thus business confidence) have anything to do with income tax rates.

The rest of your argument has one major flawed assumption - thinking business investment decisions (thus business confidence) have anything to do with income tax rates.

To small business owners, at the lower end of the scale? Yeah, they do.

I already responded as to why there is a confidence crisis in business.

Which level of business? Mega-corporations? Mid-sized small business owners? Mom-and-pop shopkeepers? They're not all the same animal and can hardly be lumped into the same group.

If you truly believe this

You're the one telling me what I do and don't believe, michty, and I sure would love it if you'd stop doing that. Like I said, there's a big difference in how/why decisions are made, depending on which level of business owner you're talking about. Not every American business is the size of G.E.

And speaking of mega-sized corporation like G.E., here's an article you may find interesting: http://www.forbes.com/2011/04/13/ge-exxon-walmart-apple-business-washington-corporate-taxes.html There are reasons mega-corps are given subsidies/tax breaks.

"...Yes, GE's lobbyists have helped get laws passed like those that grant federal tax credits for green energy investments like wind turbines. GE both builds such turbines and invests in wind farms and gets millions in such credits...."

Which side of the aisle do you imagine is pushing for the production of greenie turnbines and wind farms, michty?

Chris

Unfortunately in life there are some things that can't be independently tested, economic policies being one. What you can do is look at the data available, use your own reason and logic to make a rational decision about the success or failure of said policy. You are no doubt aware that inequality has been rising considerably in America since 1980 and that there is a lot of data and analysis that attributes this failure to trickle down economics.

"To small business owners, at the lower end of the scale? Yeah, they do.

I already responded as to why there is a confidence crisis in business.

Which level of business? Mega-corporations? Mid-sized small business owners? Mom-and-pop shopkeepers? They're not all the same animal and can hardly be lumped into the same group."

We were talking about the wealthy 'job creators' (sorry, using that term makes me laugh) affected by the impending income tax increases. I am saying that income tax rates have absolutely nothing to do with business confidence, especially in this group and absolutely not a single factor to do with the impact of any business investment or decision. Nothing, nada, zilch. I have studied and worked in finance now for 12 years and never seen one single model that factors in income tax rates in investment decisions.

I'll repeat: if someone comes to you tomorrow and says "I have a business investment that is guaranteed to make you $1m bottom line, are you in?" don't say "I don't know, I'm not sure what my tax rate will be in 6 months..." instead shake hands with him so hard you snap his hand off.

""...Yes, GE's lobbyists have helped get laws passed like those that grant federal tax credits for green energy investments like wind turbines. GE both builds such turbines and invests in wind farms and gets millions in such credits...."

Which side of the aisle do you imagine is pushing for the production of greenie turnbines and wind farms, michty?"

Which side wants to give companies tax credits for investing in jobs and infrastructure for the future of the country? Well that's an easy one lol.

You do realise that these tax credits are not the reason why GE paid no tax? You did read the article? The reason they paid no tax was because of losses brought forward, pretty straight forward... I have no idea why you posted that link or how you completely mis-interpreted this to have anything to do with what we are discussing...

Unfortunately in life there are some things that can't be independently tested, economic policies being one. What you can do is look at the data available, use your own reason and logic to make a rational decision about the success or failure of said policy.

"...it's difficult to say whether trickle-down economics was the only reason for the prosperity. That's because, while Reagan cut taxes, he also increased government spending -- by 2.5% a year. Reagan nearly tripled the Federal debt, which went from $997 billion in 1981 to $2.85 trillion in 1989. This spending went primarily to defense, in support of Reagan's successful efforts to end the Cold War and bring down the Soviet Union. Therefore, trickle-down economics was never really tested, since government spending is also a spur to economic growth." (Source: Library of Economics and Liberty, Reaganomics, William A. Niskanen)

http://useconomy.about.com/od/Politics/p/Trickle-Down-Economics-Does-It-Work.htm

Like I said.

Of course, on the other hand, if I were to "look at the data available," and "use [my] own reason and logic to make a rational decision about the success or failure of said policy," I would arrive at what's known as a personal opinion. Not fact, but opinion. There's a difference between the two.

We were talking about the wealthy 'job creators'

I wasn't. I was talking about all job creators, and specifically cited small business owners numerous times.

I'll repeat: if someone comes to you tomorrow and says "I have a business investment that is guaranteed to make you $1m bottom line, are you in?" don't say "I don't know, I'm not sure what my tax rate will be in 6 months..."

If I'm a small business owner, struggling to keep my doors open and my skeleton crew employed, and I'm paying not only personal income tax but the wide variety of other taxes that I could otherwise sink into my business, you're asking if I'm "in" on any Ralph Kramden who approaches me with a can't-miss investment opportunity? Or are we back to assuming that all businesses are the same size and, therefore, all small business owners, and mid-tier owners, would make the same decision as a mega-owner or a filthy rich person, who would be in a far better position to afford to take a risk on any Ralph Kramden who happened along?

Businesses come in ALL sizes, michty. And in a lousy economy, with high unemployment, the name of the game is to keep the little guys IN business, first and foremost, and to inspire the not-so-confident mid-tiers to risk their precious capital in expansion and, ultimately, hiring. That's not achieved by threatening to raise federal income taxes on the little guy, whose profits and personal income are often one and the same; nor is it achieved by slapping regulatory expenses on mid-tiers, money of which could otherwise go into creating new salaries. The way to build confidence at a time like this is for government to create a reeeeeeally business-friendly foundation and environment for owners, e.g., keeping taxes down, and refraining from slapping costly NEW regulations on them, and killing whatever existing regulations you can so that owners can keep as much of their money as possible. When businesses see that the government is behind them, and working for them, that's when they're gonna feel the most confident about risking their profits. Plain old common sense dictates that much.

You do realise that these tax credits are not the reason why GE paid no tax?

Did I say they were the only reason? I don't recall having made that statement.

Which side wants to give companies tax credits for investing in jobs

TEMPORARY tax credits, replete with reams of government paperwork? Yeah, small businesses aren't interested in "temporary," or in hiring a lawyer, or an extra staffer, just to deal with the paperwork. "Temporary" hiring incentives leave employers wondering what they'll do with the new employee if/when and after the incentive expires. That's why a number of O's rinky-dink "jobs creation" plans in the past have fallen short of their goals.

and infrastructure for the future of the country

With a $15.6 (and ever-growing) national debt? There are a whole lot of folks out there who want to see that debt go down, not up.

Chris

Sure, you are interpreting the fact that the Government did other things during trickle down as evidence that it didn't fail. That's fine. I'll stick to the fact that of the last 5 Presidents (including Obama) only 1 didn't implement trickle down economic and only 1 didn't have a deficit.

Aside from this, inequality has grown massively since 1980 in America. And every single economist ties this to trickle down.

"I wasn't. I was talking about all job creators, and specifically cited small business owners numerous times."

Ok so we're not discussing trickle down then! Or we can discuss the impact on small business owners, like the higher taxes they will pay to give the wealthy a tax cut under the Romney/Ryan plan?

"If I'm a small business owner, struggling to keep my doors open and my skeleton crew employed, and I'm paying not only personal income tax but the wide variety of other taxes that I could otherwise sink into my business, you're asking if I'm "in" on any Ralph Kramden who approaches me with a can't-miss investment opportunity? Or are we back to assuming that all businesses are the same size and, therefore, all small business owners, and mid-tier owners, would make the same decision as a mega-owner or a filthy rich person, who would be in a far better position to afford to take a risk on any Ralph Kramden who happened along?"

We are discussing income tax rates which you claim are the reason for lack of confidence. And yes I am saying a hypothetical investment opportunity that guaranteed a return of $X amount would be accepted REGARDLESS of income tax rates. Again: income tax rates have absolutely nothing to do with business or investment decisions.

"Businesses come in ALL sizes, michty. And in a lousy economy, with high unemployment, the name of the game is to keep the little guys IN business, first and foremost, and to inspire the not-so-confident mid-tiers to risk their precious capital in expansion and, ultimately, hiring. That's not achieved by threatening to raise federal income taxes on the little guy, whose profits and personal income are often one and the same; nor is it achieved by slapping regulatory expenses on mid-tiers, money of which could otherwise go into creating new salaries"

No-one is threatening to raise income taxes on the little guy. Obama wants to raise taxes on the big guy. Romney wants cuts all over like we're in some sort of mega-surplus budget scenario!

"The way to build confidence at a time like this is for government to create a reeeeeeally business-friendly foundation and environment for owners, e.g., keeping taxes down, and refraining from slapping costly NEW regulations on them, and killing whatever existing regulations you can so that owners can keep as much of their money as possible."

I agree. No-one is advocating raising taxes on small business owners. In fact, things like ACA are designed for small business owners to avoid even paying healthcare costs and having even more money to invest.

"Did I say they were the only reason? I don't recall having made that statement."

Well you linked to an article which discussed the 0% tax rate by GE, pointed out the tax credits and quoted only a tiny part of the article about tax credits. So yes you did imply that it was these 'greenie subsidies' that caused their 0% tax rate, to which I responded this is absolute nonsense.

"and infrastructure for the future of the country

With a $15.6 (and ever-growing) national debt? There are a whole lot of folks out there who want to see that debt go down, not up."

Yes and my entire article was about how those folks are incredibly flawed if they think austerity is the way to do this. Positive EV infrastructure investment projects are what is called 'good debt'. Building up debt for tax cuts, wars in Iraq/Afghanistan and military spending (ala George Bush) that sees no positive return to 95% of Americans is 'bad debt'.

Sure, you are interpreting the fact that the Government did other things during trickle down as evidence that it didn't fail.

Is that what I said? No, it isn't. So how about you stop misrepresenting my statements, michty? I've consistently said that there's no way to determine its failure or success.

Lol ok. Good discussion once again Chris.

Well, that's how discussions go when you misrepresent my statements for the purpose of laying a foundation to argue against something I'd never even said in the first place. Feel free to stop doing that, michty. I've asked you nicely about a dozen times, thus far. If you won't (or can't) stop doing it, that's what discussions are gonna amount to.

If you do things such as imply that a company didn't pay tax because of credits for 'greenie turbines' and this implication is completely false I am going to point out your nonsense and falsehoods every-time - you can keep playing the 'misreprsenting' card all you like after I call you out on your nonsense, it makes no difference to me. If you make false statements or implications I will call you on them.

If you do things such as imply that a company didn't pay tax because of credits for 'greenie turbines' and this implication is completely false

Did I "imply" or did you INFER? Nowhere did I say, or imply, or even intend to imply, that the greenie tax credits were the ONLY reason GE paid low taxes that year — on the heels of a 2-page article that had laid out ALL the myriad reasons for ALL the tax breaks, no less. That is what you, instead, took upon yourself to INFER, only to play YOUR conveniently drawn inferences back to me, followed by the insistence that I'm putting forth a falsehood. Enough already, michty. MY statements and YOUR inferences are not one and the same thing, so don't ascribe them to ME. I'm making this request for the last time. If you can't comply, don't expect responses to your posts.

Chris

You have to learn to take responsibility for what you say. This 'you are misrepresenting/mis-inferring stuff that I didn't mean' is not going to work in any debate or discussion. Take responsibility for your words.

You pointed to an article talking about GE paying 0% tax and quoted SPECIFICALLY the part of the article where their tax bill is reduced by green credits.

Nothing else.

Nothing on the 2 pages of the article.

None of the more important details of the article.

Only 1 paragraph about these tax credits.

A mocking comment about which party gives greenie subsidies.

Thus you were SUGGESTING (IMPLYING) that these were responsible for the 0% tax and, since Democrats are responsible for these greenie credits, that Democrats were responsible for the 0% tax rate.

"Nowhere did I say"

I don't think you know what implying means. Just because you didn't explicitly state something does not mean you didn't imply it:

IMPLY: (Verb)to indicate or suggest without being explicitly stated

You have to learn to take responsibility for what you say.

I'm fine with that, michty. In fact, I repeat my statements to you over and over and over again, because you're constantly distorting what I said, and TELLING me what I think, all in an effort to then go on to argue against that which I never said in the first place. Stop doing that if you want me to respond to your posts. I've asked you nicely about a dozen times, and I'm done with it.

Another quality debate Chris. Good work. Anyways:

http://www.balloon-juice.com/wp-content/uploads/2012/08/ryan-zero-tax-plan.gif

Economics blog that I followed just covered this exact post: http://www.economicshelp.org/blog/5615/economics/osborne-austerity-measures-are-not-working/